estate tax change proposals 2021

The Biden Administration has proposed sweeping estate tax impacts to the estate and gift structure. New Tax Proposals - Good News for Most Taxpayers - N ot Much is Scheduled to Change.

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Proposals to decrease lifetime gifting allowance to as low as 1000000.

. Potential Estate Tax Law Changes To Watch in 2021. That is only four years away and. If a decedent were to die in 2021 with an estate of 11700000 there would be zero tax due on the estate and a full step up in tax basis on all assets to the value on the.

By Cona Elder Law. President Bidens new tax proposals to the Build Back Better Act are. November 16 2021 by Jennifer Yasinsac Esquire.

In September we posted on the sweeping tax changes proposed by The Ways and Means Committee of the House of Representatives. Revenue raising proposals usually mean finding a way to collect more tax dollars. One of the plans is reverting the estate and gift tax exemption to 5 million according to a summary of the proposals exposing estates and gifts above that amount.

New federal tax legislation is on the horizon with significant changes for estate and gift taxes. Estate and gift tax exemption. Thankfully under the current proposal the estate tax remains at a flat rate of 40.

The 2021 estate tax exemption is currently 117 million which was an increased amount from 545 million enacted under the Tax Cuts and. PROPOSED ESTATE AND GIFT TAX LAW CHANGES OCTOBER 2021. The 2017 Trump Tax Cuts raised the Federal Estate Tax Exemption to 1118 million for tax year 2018.

The gift estate and GST generation skipping transfer tax exemptions are 117 million per person adjusted for inflation. Reducing the Estate and Gift Tax Exemption. President Bidens Build Back Better plan currently wending its way through Congress.

Estate tax rate staying put. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. When President Barack Obama took office in 2009 the exemption was 35 million with a 45 percent tax above that amount.

Its now 117 million a person with a 40. The 2021 exemption is 117M and half of that would be 585M. Currently the lifetime Estate and Gift Tax exemption is at 117 million but will revert back to approximately 62 million by 2026.

If this proposal were to become. Click to play an audio version of this article. The proposed bill reduces the federal estate and gift tax exemption from 117 Million per person to 5 Million per person indexed.

Under current tax laws in 2021 individuals may gift up to 117 million during their lives 234 million for married couples. This means if an individual dies in 2022 and his or her lifetime gift and estate assets add up to be greater than 62 million t. 2021 Estate Tax Proposals.

This amount could increase some in 2022 due to adjustments for inflation. July 13 2021. The Biden Administration has proposed significant changes to the.

Ad From Fisher Investments 40 years managing money and helping thousands of families. Then the gift and estate tax exemption is lowered from 117 million to 6 million with the gift and estate tax rate increased from 40 to 45 all effective January 1 2022. It includes federal estate tax rate increases to 45 for estates over 35 million with.

The current 2021 gift and estate tax exemption is 117 million for each US. November 03 2021. Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11 million to 5 million adjusted for inflation.

The exemption was indexed for inflation and as of 2021 currently. July 13 2021. The House estate tax proposal is to accelerate the 2026 reduction to 2022.

The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million. At the end of March Senators Bernie Sanders and Sheldon Whitehouse introduced a bill they. If the exemption is decreased from 117 million to.

The proposed bill reduces the federal estate and gift tax exemption from 117 Million per person to 5 Million per person indexed for inflation prior to the scheduled sunset. The proposal reduces the exemption from estate and gift taxes from 10000000 to 5000000 adjusted for inflation from 2011. Bernie Sanders introduced an 18-page bill called the For the 995 Percent Act.

The House Ways and Means Committee released tax proposals to. Consumer IssuesConsumer Protection News and Events.

Potential Impact Of Estate Tax Changes On Illinois Grain Farms Farmdoc Daily

Tax Increase Talk Prompts Wealthy To Splurge On Muni Bonds Bond Funds Corporate Bonds How To Raise Money

A Closer Look At 2021 Proposed Tax Changes Charlotte Business Journal

Summary Of Fy 2022 Tax Proposals By The Biden Administration

Faq What You Need To Know About The Property Tax Proposals On Texas May 7 Ballot Texas Standard

House Democrats Propose Tax Increases In 3 5 Trillion Budget Bill

Potential Impact Of Estate Tax Changes On Illinois Grain Farms Farmdoc Daily

Biden S Proposed 39 6 Top Tax Rate Would Apply At These Income Levels

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

House Ways And Means Committee Tax Proposal

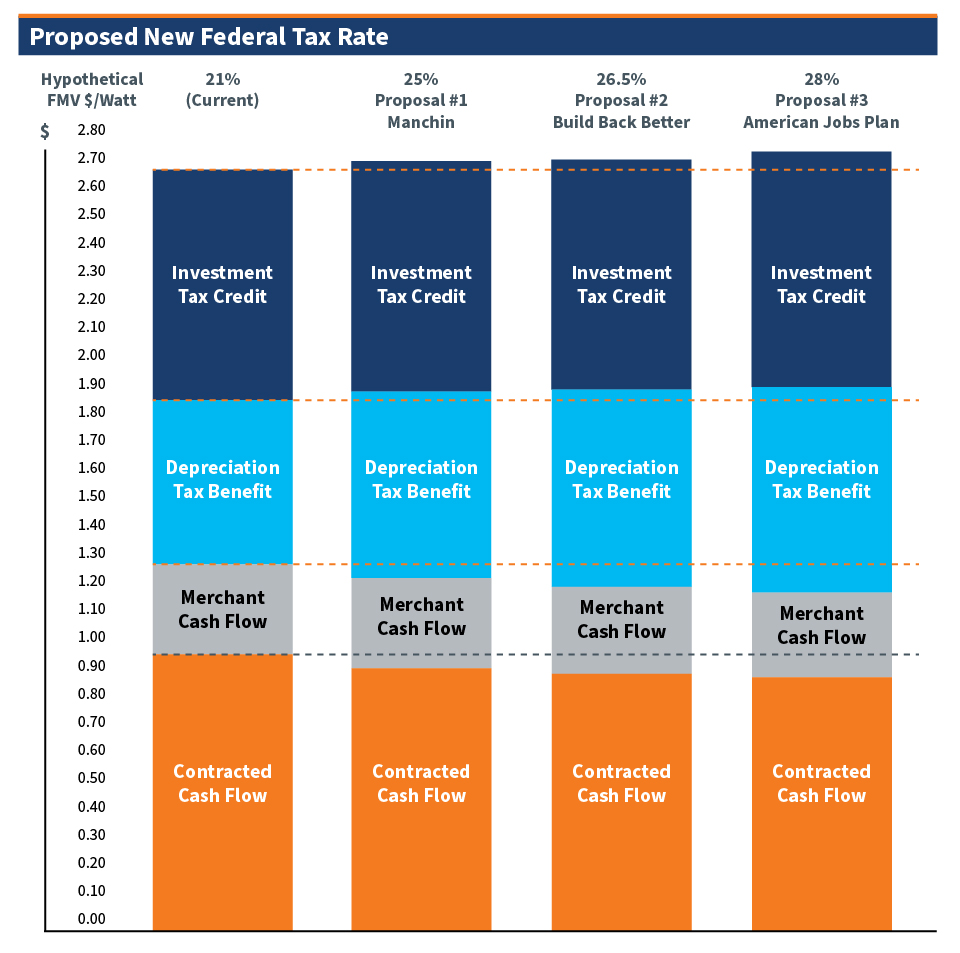

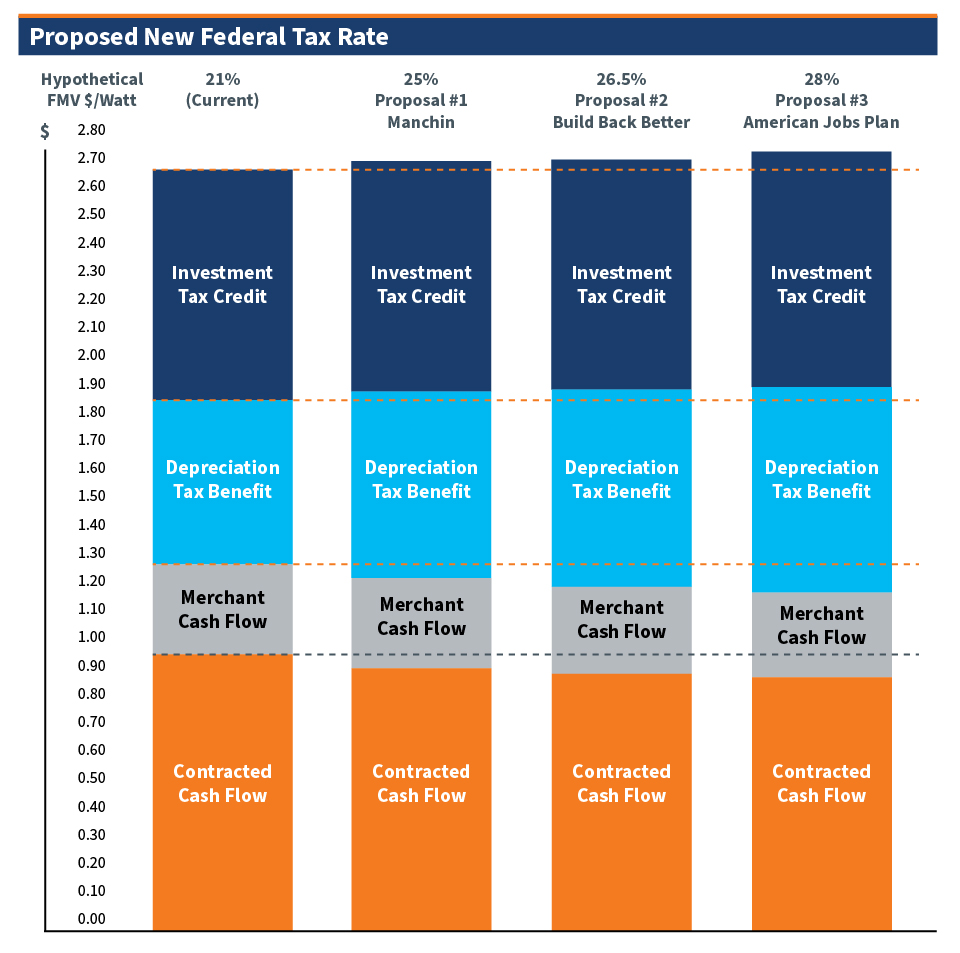

What Do Federal Tax Proposals Mean For Solar Valuations

Summary Of Fy 2022 Tax Proposals By The Biden Administration

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

Free Editable Startup Funding Proposal Template Word Template Net Startup Funding Proposal Templates Up Proposal

Will Joe Biden S Proposed Taxes On Capital Make America An Outlier The Economist

Current Status Of Federal Estate And Gift Tax Proposals Ruder Ware Jdsupra

What To Know About President Biden S Tax Proposals

Overview Of Proposed Tax Law Changes

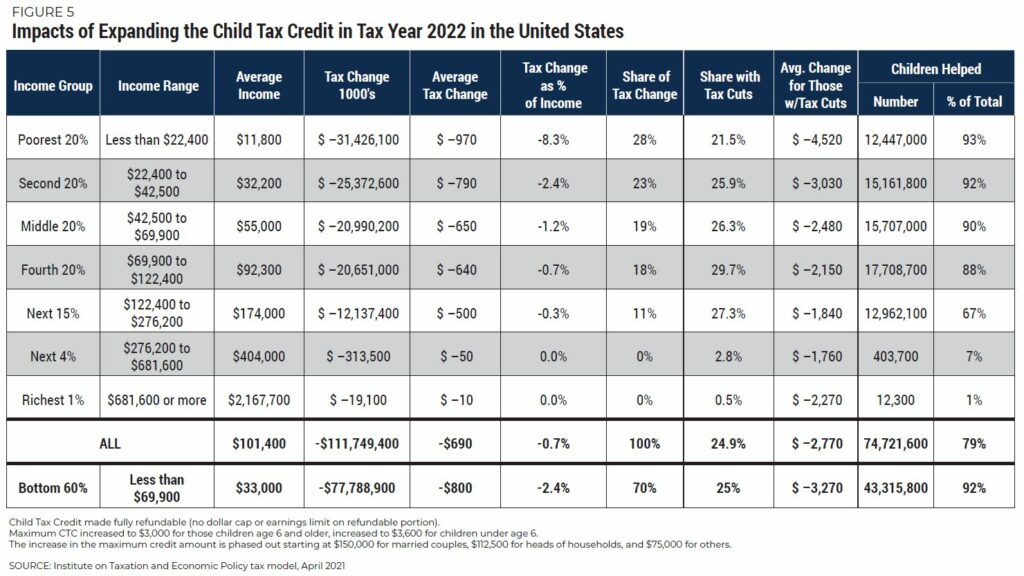

National And State By State Estimates Of President Biden S Campaign Proposals For Revenue Itep